Valuation of Life Insurers: 2015

Publication IRMI

Author Jeff Balcombe

This article was originally printed in the August 2015 issue of IRMI Magazine. Read it here.

This article will discuss the relationship between interest rate risk and the valuation of life insurance companies. In addition, this article will touch on ways to mitigate risk attributable to interest rate fluctuations as well as the current and expected interest rate environment as it relates to life insurance company valuations.

VALUATION FRAMEWORK

Below is a simple formula that can be used as a framework for considering the relevant issues in analyzing the relationship between interest rates and a firm's equity value:

Equity Value = Asset Value - Liability Value

The majority of the insurance industry's assets are investments in bonds and other non-equity instruments, while liabilities typically consist of products sold and the ability to meet policy commitments. Consequently, life insurance is a liability-driven business, as it is the life insurer's business to take today's funds in exchange for the promise to make payments in the future.

BUSINESS MODEL

The assets and liabilities of life insurers have a unique relationship. Life insurers collect premiums from policy owners, which they invest in stocks and bonds. Insurers aim to generate returns in excess of their liabilities through investment income and capital gains. This income is then shared with policyholders through annuities or the policy's cash value. Accordingly, the life insurance industry is greatly impacted by its exposure to the financial sector.

As a result of this business model, life insurers' assets and liabilities are heavily exposed to interest rate risk. Earnings are dependent on the spread between investment returns and the interest paid on each insurance policy or product. When interest rates are low, insurance companies may be unable to meet contractually guaranteed obligations to policyholders solely from investment income.1 As such, insurance companies strive to match liability cash flows with cash flows from investment earnings in order to avoid an asset-liability reserve. However, when interest rates are too low, the cash flows may not match up, exposing insurers to losses from the sale of assets that did not make economic sense. In these instances, companies will typically see a decrease in earnings.

INTEREST RATE IMPACT ON EARNINGS

As a result of changes in interest rates, earnings spread compression is a major risk for life insurance companies. Life insurers generate income by producing portfolio returns in excess of what they owe on policies. A majority of this investment income is related to fixed-income securities. The prices and returns of these securities are highly dependent on interest rates. For example, high interest rates allow insurers to generate more investment income from fixed-income securities due to higher yields. On the contrary, low interest rates reduce investment earnings because the income is being reinvested at a lower rate, exacerbating the earnings spread compression.2 Persistent low rates, like those experienced over the past several years, may hinder investments from generating enough income to meet obligations to policyholders.

Alternatively, an increasing interest rate environment creates disintermediation risk. Disintermediation risk refers to the potential that policyholders may surrender policies due to favorable interest rates. As interest rates rise, the disintermediation risk grows as policyholders have the opportunity for greater returns if they withdraw funds from their policy and invest them elsewhere.

During the past few years, interest rates have remained relatively low. However, interest rates are anticipated to increase into the future at a fairly mild pace.3 Thus, it does not appear that disintermediation risk will be a near-term problem for life insurers.

INTEREST RATE IMPACT ON PRODUCTS AND CONSUMERS

Life insurers are exposed to interest rate risk based on the behavior of policyholders. Policyholders will choose certain insurance products with the insurance rate environment in mind. Three of the most popular life insurance products include fixed annuities, lump-sum payments, and deposit-type investments.

A fixed annuity promises a specified return on investments for an extended period of time. As liquidity demands decrease, policyholders will want to keep money in a more secure investment vehicle, such as the annuities offered in many life insurance products. Additionally, when rates are low, life insurers only profit from these annuities if the annuity's contracted return is lower. Accordingly, there is less demand for these products with a low return, making it difficult for insurers to sell.4

In addition, some life insurance policies allow a beneficiary to receive a lump-sum payment on a policyholder's death. A decline in interest rates will cause a policy's future payments to be covered more from asset sales than investment income, increasing the insurer's liability.5

Lastly, deposit-type products include guaranteed investment contracts and funding agreements, which are primarily sold to institutional clients. These products function like a bank certificate of deposit, with policyholders able to receive interest and principal repayment in the future. These products are solely a savings vehicle.

MANAGING INTEREST RATE RISK

Because interest rate volatility can pose a threat to life insurance companies, it is important for insurers to protect themselves against interest rate risk. Many insurance companies have created several tools to help address the risk of low interest rates.

One strategy for addressing this risk is duration matching. Duration is defined as "the number of years required to recover the true cost of a bond, considering the present value of all coupon and principal payments received."6 The concept of duration involves matching asset duration to liability duration in order to limit companies' exposure to interest rate risk. By matching the durations, the price sensitivity of surplus to interest rates becomes smaller. Increasing the duration of assets allows companies to better match assets with liabilities, which is one of the insurers' key risk mitigation strategies.7 However, it is often difficult or impossible for insurers to match the duration of the liabilities, as assets with equivalent maturities are not always readily obtainable.8 As such, greater duration mismatch creates greater risk for the insurer.

Interest rate risk can also be reduced by diversification of products and investments. Large insurers are more capable of managing risk through diversifying assets. Insurers can balance interest-sensitive offerings with non-interest-sensitive products. Additionally, they can diversify their investments. In recent years, with unusually low rates on treasuries, 48.8 percent of the industry's investment income came from bonds, followed by stocks at 32.6 percent. In addition, investment income can come from mortgage loans, contract loans, and real estate holdings.9 Insurers also engage in derivatives like fixed-income futures and interest rate floors, swaps, and swaptions to mitigate the risk of prolonged low interest rates.10 Life insurers use derivatives to reduce risk and hedge against losses in the future.11 By using derivatives, a life insurer with a large portfolio of guaranteed death benefit annuities will have the ability to hedge against any decline in the equity markets. Life insurers typically sell long-term contracts, which have a greater sensitivity to interest rate fluctuation.

Although insurers do take measures to manage interest rate risk, the extent to which they can mitigate this risk is limited, particularly in a situation of prolonged low interest rates. In these situations, insurers will obtain lower terms on new policies by lowering guaranteed rates in order to see a decrease in liabilities.12 As previously stated, the persistence of low interest rates also forces insurers to reinvest at lower rates, exacerbating the effect.13 If the interest rate market continues to remain low, life insurance companies could be at risk for solvency.

INTEREST RATE IMPACT ON VALUATION MULTIPLES AND CURRENT TRENDS

One metric that is heavily utilized by insurance industry analysts to assess equity valuations is the price-to-earnings (P/E) multiple. The P/E multiple represents the value of a firm's equity per dollar of earnings and can be based on historical earnings, such as net income during the latest 12 months, or forward earnings, such as net income expected in the next 12 months. By analyzing trends in valuation multiples, analysts can gain a better understanding of the market's assessment of a company's growth prospects and risk profile, both of which could be impacted by the interest rate environment.

In order to analyze the effect of the interest rate environment on the valuation multiples of life insurance companies, we analyzed the following publicly traded companies (the "Life Insurance Industry Group"), as we considered them representative of the industry as a whole:

- AFLAC, Inc. (AFL)

- CNO Financial Group, Inc. (CNO)

- Kansas City Life Insurance Company (KCLI)

- Lincoln National Corporation (LNC)

- Manulife Financial Corporation (MFC)

- MetLife, Inc. (MET)

- National Western Life Insurance Company (NWLI)

- Principal Financial Group Inc. (PFG)

- Prudential Financial, Inc. (PRU)

- StanCorp Financial Group (SFG)

- Sun Life Financial Inc. (SLF)

- Symetra Financial Corporation (SYA)

- The Phoenix Companies, Inc. (PNX)

- Torchmark Corporation (TMK)

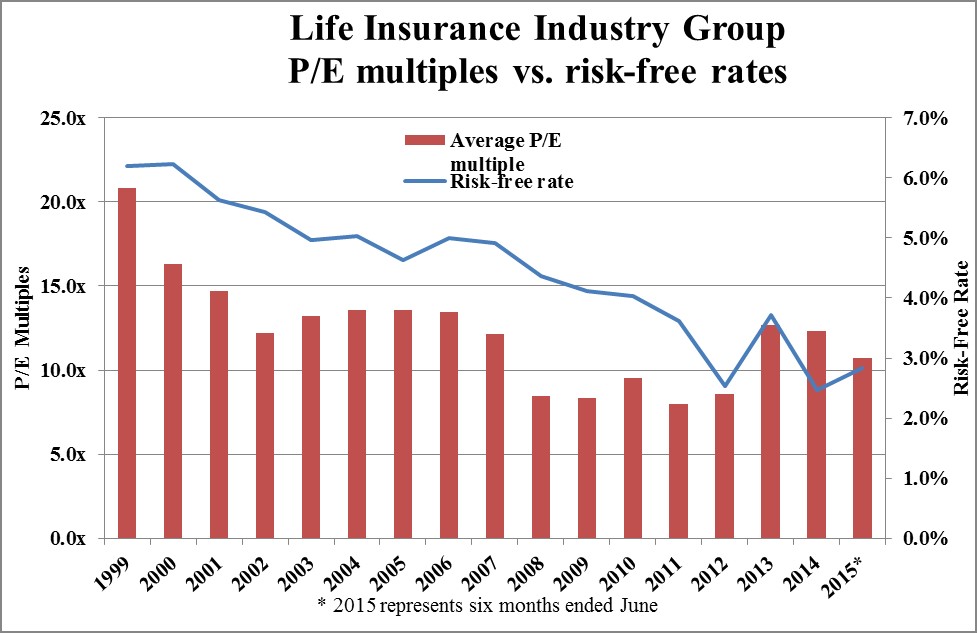

The following graph compares P/E multiples to interest rates and suggests that during periods of prolonged low interest rates, there is more perceived risk for life insurance companies, as indicated by lower P/E multiples. Slight increases in interest rates seem to promote confidence in the financial stability and value of these companies.

While still below historical levels, interest rates have been rising in the last few months, allowing fixed-rate annuities and similar products to perform better. The interest rate impact is at least partly due to the fact that life insurers are long-term investors with a low risk tolerance. Accordingly, life insurers typically use fixed-income securities to earn returns. With much of the insurers' investment income relating to fixed-income securities, returns are highly affected by interest rate movements. However, other factors also impact this general trend. For example, improvements in the S&P 500 index caused the spike in the P/E ratio in 2013, which carried over into 2014.14 Despite the current low interest rate environment, life insurers have performed well in 2015. As the economy continues to stabilize, investment income should gradually increase along with the continued improvements in equity markets.15 As such, investors are optimistic about insurance companies as is reflected by higher P/E multiples.

OUTLOOK

Changes in interest rates can pose a significant challenge to insurers, so understanding the impact of rate changes is important. Much of the business on the insurers' books tends to perform poorly in very high or very low interest rate environments. The ideal situation for most life insurers would be for rates to gradually return to "normal" levels.16

High interest rates allow insurance companies to generate more investment income as a result of higher yields. It is expected that the 10-year Treasury note yield will increase through 2015.17 However, despite the increase, interest rates are projected to remain lower than pre-recessionary levels throughout 2015.

An increase in interest rates on both bonds and debt-market securities should boost investment income and foster improvements in financial performance in the life insurance industry.18 Furthermore, the anticipated rise in interest rates over the second half of the next 5 years, among other factors, is expected to support an increase in growth in industry revenue at an annualized rate of 2.6 percent.19 Once interest rates rise, life insurers' cash flows should improve, relieving pressure on reserve requirements and helping insurers recover their previous capital positions.20

Additionally, insurers are expected to continue to be more conservative in investment exposure, with many companies looking to find a better risk-management analytics system on which to rely, in order to mitigate the volatility of the interest rate market.

Overall, it is anticipated that life insurers' financial performance will improve throughout 2015 because of a stronger equity market and more conservative products and pricing. The strengthening of the US economy should also enhance industry revenue. As unemployment rates decline and the stock market rebounds, US households are expected to have more discretionary spending available for life insurance and annuity products.21

1National Association of Insurance Commissioners, "Low Interest Rates," NAIC.org (July 10, 2015).

2Stephen Hoopes, "Way of Life: Unemployment Will Remain High, but a Risk in Investment Income Will Boost Revenue," IBISWorld Industry Report 52411a Life Insurance & Annuities in the US, IBISWorld (May 2015).

3Bill Conerly, "Interest Rate Forecast 2015 – 2016," Forbes.com (July 13, 2015).

4National Association of Insurance Commissioners, "Low Interest Rates," NAIC.org (July 10, 2015).

5Kyal Berends, Robert McMenamin, Thanases Plestis, and Richard J Rosen, "The Sensitivity of Life Insurance Firms to Interest Rate Changes," Federal Reserve Bank of Chicago (Q2 2013).

6Kyal Berends, Robert McMenamin, Thanases Plestis, and Richard J Rosen, "The Sensitivity of Life Insurance Firms to Interest Rate Changes," Federal Reserve Bank of Chicago (Q2 2013).

7National Association of Insurance Commissioners, "Low Interest Rates," NAIC.org (July 10, 2015).

8Kyal Berends, Robert McMenamin, Thanases Plestis, and Richard J Rosen, "The Sensitivity of Life Insurance Firms to Interest Rate Changes," Federal Reserve Bank of Chicago (Q2 2013).

9Stephen Hoopes, "Way of Life: Unemployment Will Remain High, but a Risk in Investment Income Will Boost Revenue," IBISWorld Industry Report 52411a Life Insurance & Annuities in the US, IBISWorld (May 2015).

10Larry Bruning, Shanique Hall, and Dimitris Karapiperis, "Low Interest Rates and the Implications on Life Insurers," The Center for Insurance Policy and Research Newsletter (April 2012).

11Stephen Hoopes, "Way of Life: Unemployment Will Remain High, but a Risk in Investment Income Will Boost Revenue," IBISWorld Industry Report 52411a Life Insurance & Annuities in the US, IBISWorld (May 2015).

12National Association of Insurance Commissioners, "Low Interest Rates," NAIC.org (July 10, 2015).

13MetLife, Inc., Annual Report 10-K 2014, retrieved from Capital IQ database (2014).

14Stephen Hoopes, "Way of Life: Unemployment Will Remain High, but a Risk in Investment Income Will Boost Revenue," IBISWorld Industry Report 52411a Life Insurance & Annuities in the US, IBISWorld (May 2015).

15Stephen Hoopes, "Way of Life: Unemployment Will Remain High, but a Risk in Investment Income Will Boost Revenue," IBISWorld Industry Report 52411a Life Insurance & Annuities in the US, IBISWorld (May 2015).

16John Fenton, Mark Scanlon, and Jaidev Iyer, Interesting Challenges for Insurers, Towers Watson (Mar. 2011).

17Stephen Hoopes, "Way of Life: Unemployment Will Remain High, but a Risk in Investment Income Will Boost Revenue," IBISWorld Industry Report 52411a Life Insurance & Annuities in the US, IBISWorld (May 2015).

18Stephen Hoopes, "Way of Life: Unemployment Will Remain High, but a Risk in Investment Income Will Boost Revenue," IBISWorld Industry Report 52411a Life Insurance & Annuities in the US, IBISWorld (May 2015).

19Stephen Hoopes, "Way of Life: Unemployment Will Remain High, but a Risk in Investment Income Will Boost Revenue," IBISWorld Industry Report 52411a Life Insurance & Annuities in the US, IBISWorld (May 2015).

20National Association of Insurance Commissioners, "Low Interest Rates," NAIC.org (July 10, 2015).

21"Moody's Outlook for US Life Insurance Industry Remains Stable for 2015," Moodys.com, Moody's Investor Service (July 13, 2015).

Opinions expressed in Expert Commentary articles are those of the author and are not necessarily held by the author's employer or IRMI. Expert Commentary articles and other IRMI Online content do not purport to provide legal, accounting, or other professional advice or opinion. If such advice is needed, consult with your attorney, accountant, or other qualified adviser.