Optimizing Capital Structure and the Level of Debt Assumption

This article was originally printed in the April 2016 issue of Financial Valuation and Litigation Expert Magazine. Read it here.

Not withstanding purely theoretical arguments that investors should be indifferent to capital structure,1 in practice the relative combination of debt and equity capital utilized in calculating the weighted average cost of capital (WACC) can have a material impact on a valuation. However, valuation analysts tend to oversimplify assumptions regarding capital structure by relying solely on public guideline companies, resulting in inaccurate valuations. In my experience, third party reviewers, such as auditors, seeking simple and objective measures are encouraging this approach. While simplicity and objectivity are desirable objectives, they should not supplant well-reasoned analysis. Rather than a simple mechanical process, determining the correct capital structure requires the appraiser to maintain appropriate perspective when considering the underlying assumptions, defining the market participants, and assessing the reasonability of the chosen capital structure.

THEORETICAL UNDERPINNINGS BEHIND THE CAPITALS STRUCTURE ASSUMPTION

As described in various treatises, the theoretical optimal capital structure for an entity is the point at which the weighted average cost of debt and equity capital is minimized; a point that can be described as the limit for which the incremental after-tax cost of debt exceeds the increase in risk of financial distress resulting from the increase in debt, as shown in Figure 1 below.2

The most common method for estimating capital structure is based on a review of guideline public companies or published industry statistics, which themselves are often based on public company data. Typically, either a central tendency measure (such as a mean or median) or an estimate based on a subset of the most relevant guideline companies is selected. Of course, by relying on these statistics, the inherent assumption is that the public guideline companies or industry participants provide a reasonable proxy for the subject company’s optimal capital structure.

Jules Van Binsbergen, John Graham, and Jie Yang provide a practical framework for calculating a firm-specific optimal capital structure based on firm-specific estimates of cost and benefit of debt functions.3 Their paper on optimal capital structure further defines the differences between “absolute” optimal capital structure, or the point specific to a firm where its marginal benefit of debt and marginal cost of debt are equal, and “relative” optimal capital structure, or the optimal capital structure of a firm based on the capital structures of its guideline companies.

There is no single accepted methodology for determining optimal capital structure. To their own question of whether there is a theory of optimal capital structure, Brealey, Myers, and Allen flatly answer “No. There is no one theory that can capture everything that drives thousands of corporations’ debt versus equity choices.”4 That said, a valuation analyst must make a reasoned effort to derive an appropriate assumption for the capital structure. Unfortunately, capital structures selected solely based on computations from a set of publicly traded guideline companies, or published industry data, often fail to consider other important factors that should be taken into account.

SUBJECT COMPANY CONSIDERATIONS

If the subject company is expected to continue “as is” (as is typical in a minority interest valuation), a valuation analyst would simply assume that the actual capital structure will continue, or in some cases, make an assumption based on management’s stated target capital structure. However, for controlling interest valuations under the fair market standard, many analysts assume the capital structure that a hypothetical buyer or market participant would target, deducing that a hypothetical buyer or market participant who has the power to do so, would seek to maximize value by optimizing the capital structure to achieve the lowest cost of capital available.

While most practitioners would agree that a control-level buyer will have the ability to change the subject company’s capital structure, one should not ignore the circumstances of the subject company on the valuation date, when making such decisions. Pratt and Grabowski point out, “it would be important to understand how the industry-average capital structure is derived and whether or not it is reasonable to expect the subject company to achieve it given (1) the current conditions of the company itself and (2) the current financial market conditions.”5

An important factor to consider are the operational differences between the subject company and the guideline companies, which may influence the optimal capital structure. For example, one industry player may elect to hold and finance significant inventory while another chooses a justin- time production process. Additionally, in many instances, public companies may enjoy greater access to capital not only in the equity markets, but also in the debt markets, when compared to otherwise similar closely held industry participants. One must consider the practical limits to borrowing available to the subject company. If, for example, lenders would require personal guarantees from the ownership in order to borrow to the level of the public guideline companies, unless the analyst is asked to assume that the personal guarantee is included as part of the business enterprise, the ability to borrow based on personal guarantees should be ignored.

The examples above are just a couple of the many ways that the subject company may differ from publicly traded counterparts. Given these potentially important differences, simply selecting a capital structure based on public guideline companies that are in fundamentally different positions than the subject company may result in an unrealistic capital structure assumption.

RELEVANT UNIVERSE OF MARKET PARTICIPANTS

When determining “fair market value,” practitioners are asked to consider the perspective of a hypothetical buyer and seller. Likewise, when considering “fair value,” in a financial reporting context, one is expected to conduct the analysis through the lens of a “market participant.” While most practitioners are comfortable with these concepts on an abstract level, in practice, some kind of assumption is necessary with respect to the nature of the hypothetical parties that constitute the universe of willing buyers/sellers, especially the factors that may drive the capital structure decisions within the universe of market participants.

Possible exit strategies for a hypothetical seller may include: (1) a sale to a private equity firm, (2) a sale to a strategic industry buyer, or (3) an IPO. Different groups of potential buyers may have very different ideas as to the preferred capital structure. As an example, private equity funds—which are often structured in such a way to incentivize fund managers based on absolute returns, with much less consideration given to the level of risk—will typically have a greater appetite for risk than a multi-national strategic buyer or the institutional investors who might be participating in an initial public offering. Also, as part of monetizing their investment, private equity firms frequently will engage in dividend recapitalizations, whereby, provided the company is solvent afterwards, debt is added to the capital structure and a dividend is paid out. A recent survey of private equity firms reflected an average target capital structure consisting of 60 percent debt (or alternatively, 4.0 turns of EBITDA),6 a level of leverage that is higher than what is frequently observed in most industries in the public markets.

As such, in some valuation scenarios, there may be a significant dichotomy between the capital structure a market participant would expect and the optimal capital structure as defined by observation of the comparable guideline public companies. Consider a hypothetical valuation in which the comparable guideline companies present a median debt to total capital of 30 percent. However, the pool of potential buyers consists primarily of private equity investors. As described in the aforementioned PE survey, the appraiser may correctly conclude on a 60 percent debt to total capital weighting to better reflect the target capital structure for the pool of PE buyers. While this chosen capital structure for our valuation may not appear optimal for the firm itself and may represent a significantly different risk profile, it is reflective of the target capital structure for the market participants and should be considered.

RECOGNIZING PROBLEMS WITH PUBLIC DATA

Although practitioners should consciously consider differences that may exist between the subject of the valuation and publicly traded guideline company data, this does not mean that the empirical data available from the public markets is unimportant. In fact, such data points should almost always be considered, at least to some degree. However, it is important that when taking this information into consideration, that the practitioner recognize and account for issues that, if unrecognized, may cause such data to be misleading.

First, when assessing the data set developed, it is important that the practitioner be cognizant of differences that may exist among the guideline companies and consider these differences in the context of the practices of the subject company. In order to accurately determine comparable guideline company debt, the analyst must include “debt-like” off-balance sheet items such as capitalized operating leases and underfunded liabilities (such as pension liabilities). In industries with significant capital leases, adding them to debt can have a significant impact on the capital structure.

Additionally, it is important to take into consideration any hybrid debt instruments or preferred equity when determining the degree of leverage employed by the guideline companies. An analyst should remember to consider and account for these differences when formulating a capital structure assumption. Additionally, the capital structure reflected in the guideline companies at a moment in time may not reflect that industry’s long-term optimal capital structure. Equity markets incorporate new information and adjust pricing quickly. However, companies are often slow—whether imposed internally or externally—to adjust leverage for market fluctuations. Consequently, the amount of debt a company carries may differ greatly from what is considered to be optimal given current market conditions. As an example, the oil and gas industry invested heavily in development of reserves (often borrowing to do so) through much of 2014 as energy prices remained high; however, once energy prices declined (and along with it, equity values), many oil and gas companies found themselves in overleveraged positions.7 When evaluating market data, analysts should not only analyze the leverage observed in the guideline company set at the valuation date, but should also consider historical levels of leverage, as this may provide a better indication of the longterm optimal capital structure of subject industry.

Even if one properly considers the issues noted above, it is still common to have market data that does not necessarily cluster around a theoretically “optimal” capital structure. In practice, it is not unusual to have guideline company data sets with highly divergent capital structures. It is important to remember that market data should be only one option in the “toolbox” when evaluating capital structure. The degree of weight that should be given to the guideline company capital structure should be based on the analyst’s assessment of the overall reliability and applicability of that data.

REASONABLENESS TEST

Going back to the earlier discussion, the theoretical optimal capital structure is the point at which the WACC isminimized. Therefore, a company optimizes capital structure by borrowing up to the point that the incremental costs associated with additional borrowing in the form of risks of bankruptcy or financial distress outweigh the tax benefits arising from borrowing. To find this point, one can evaluate the borrowing capacity of the subject company. This can be evaluated by assessing the stability of cash flows, considering lender covenants, and discussing borrowing capacity with management or even the subject company’s primary lender. Additionally, a framework for estimating borrowing capacity can be created based on the subject company’s asset mix.

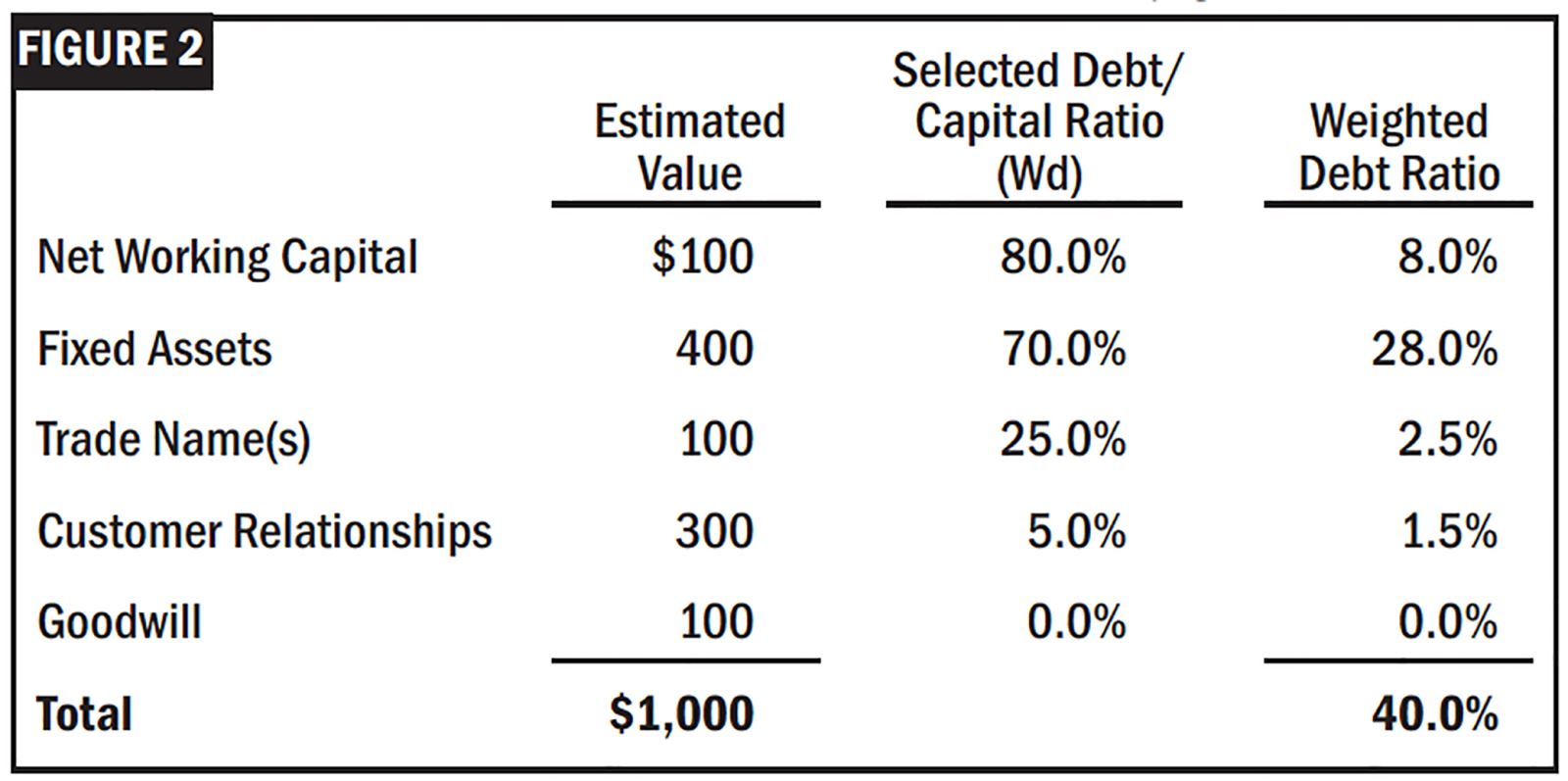

Recognizing that the borrowing capacity is derived from the various assets that comprise the subject company, the framework involves estimating respective values and borrowing capacities for the company’s underlying assets. When performing a purchase price allocation for financial reporting compliance purposes, practitioners will typically perform a weighted-average return on assets calculation (WARA). In order to compute the WARA, the value, along with the required rate of return for all assets of the business, must be selected. Given that an appropriate rate of return for each of the assets is estimated, capital structure for each asset must be approximated. Thus, a weighted average debt-to-total capital can be calculated based on the assets of the business, as shown in the calculation in Figure 2 below.

This level of granularity regarding the value and returns for the intangible and tangible assets may not be available for most types of valuations. However, the concept can still be applied as a reasonableness test. The assets can be broken down into several large categories such as working capital, fixed assets, intangible assets, and goodwill, with a capital structure applied to each asset grouping. While the assumption regarding the capital structure of each asset grouping may be subjective, the actual asset mix of the subject company can be utilized, providing a different perspective, or reasonableness check, in determining capital structure. Also, the company may have actual borrowing facilities or relationships with financial institutions that can provide insight into the financing weightings for different types of assets. For instance, assuming significantly high levels of equity in the capital structure may not make sense if the subject firm’s asset mix is primarily composed of fixed assets and working capital, which are conventionally financed mostly with debt.

CONCLUSION

In many valuations, particularly thoseinvolving the valuation of a controlling interest, the appraiser will, in many cases, need to adjust to a hypothetical capital structure that is in line with what a hypothetical control-level buyer would expect to employ. The most conventional method for estimating this hypothetical capital structure is based on guideline public companies or industry surveys based on public company data. This is likely driven by the goal of achieving objective and relatively simple methods for obtaining valuation assumptions. Unfortunately, while objective and simple, purely relying on data from publicly traded industry participants can be an oversimplification that leads to inaccurate results.

While publicly traded guideline company data is relevant and should be considered, it should not be the sole consideration when determining the optimal capital structure for the subject company. As detailed herein, there are a number of considerations that should be taken into account before making a determination of the controllevel capital structure. Additionally, the subject company’s borrowing capacity is an important consideration when setting capital structure assumptions. A framework that takes into account the subject company’s constituent assets can provide a valid reasonableness check against which to evaluate capital structure assumptions derived from publicly traded guideline companies and other sources.

1 Modigliani and Miller proposed that in a theoretically “perfect market,” where there are no taxes or costs associated with bankruptcy or financial distress, an investor should be indifferent to capital structure. For a discussion regarding Modigliani and Miller’s proposition regarding capital structure indifference, see Brealey, Myers and Allen, Principles of Corporate Finance, tenth edition, p. 418.

2 See, for example, Pratt & Grabowski, Cost of Capital, Applications and Examples, fifth edition, p. 550.

3 See Van Binsbergen, Graham, and Yang, Optimal Capital Structure, April 2011.

4 Brealey, Myers, and Allen, Principles of Corporate Finance, tenth edition, p. 465. (Emphasis in original)

5 Pratt, Valuing a Business, fifth edition, p. 219.

6 Gompers, Kaplan, and Mukharlyamov, “What Do Private Equity Firms Say They Do?” Harvard Business School, working paper 15-081 (2015), p. 21.

7 An additional reminder in situations where there is a high degree of leverage is that the face amount of debt may not properly state the market value of the debt, so the commonly used shortcut of using the face value of debt as a proxy for its market value may break down in these situations.